In Blake Gopnik's final article for Newsweek, I found a few lines that hit close to home. Not only does some of it apply to me, but many encapsulate my anxiety about collecting. Ouch.

When people are attracted to high prices, rather than put off by them, that’s one indicator of a swelling bubble.

As one New York art adviser warns, “The market has to come down—because it has to. They don’t call it a market because it only goes up. You call that ‘magic.’”

The newfound popularity of art fairs, which are more like souks than salons, may signal that the boom is being fueled by the pleasure found in buying art rather than in contemplating it. That’s the kind of faddish pleasure that could pass as quickly as the hula hoop.

She’s (Mary Boone) sanguine that the market will continue to support her, but she also lists all sorts of novel problems in it: speculators who buy just to sell; collectors who stop buying once their walls are full; people who only buy because their friends do; the “spectator sport” that art buying has now become; all the shallow, “sellable” art being churned out; the exclusive search for the new and the hot—so that an unproven artist such as Wade Guyton, now showing at the Whitney Museum in New York, can fetch more than a legend of pop art like Richard Artschwager, on view downstairs from Guyton’s work.

(Every gallerist I spoke to insisted that the market for their particular, singularly talented artists was bound to be stable, even if their colleagues were clearly at risk—precisely the kind of bulletproof thinking that’s typical of boom times.)

That Barclays survey showed that once millionaires own a precious object, they will only sell it at a vast profit. (Market psychologists call this the “endowment effect.”) Just because you think the value of your collection is falling, “you’re not going to take your paintings off the wall,” says Adam Lindemann, a financier, collector, and gallery owner in New York.

Of course, the fact that collectors choose not to sell now, or in 2013, or even in a decade doesn’t change the underlying drop in worth of any bad art they own. If a work doesn’t end up mattering in the culture at large, someone, someday, will be left holding the bag.

To wit...

When people are attracted to high prices, rather than put off by them, that’s one indicator of a swelling bubble.

As one New York art adviser warns, “The market has to come down—because it has to. They don’t call it a market because it only goes up. You call that ‘magic.’”

The newfound popularity of art fairs, which are more like souks than salons, may signal that the boom is being fueled by the pleasure found in buying art rather than in contemplating it. That’s the kind of faddish pleasure that could pass as quickly as the hula hoop.

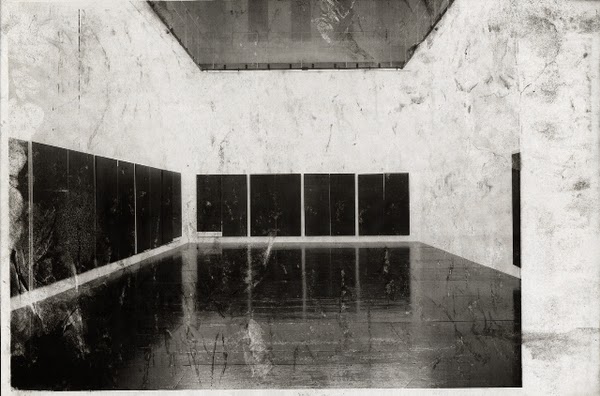

She’s (Mary Boone) sanguine that the market will continue to support her, but she also lists all sorts of novel problems in it: speculators who buy just to sell; collectors who stop buying once their walls are full; people who only buy because their friends do; the “spectator sport” that art buying has now become; all the shallow, “sellable” art being churned out; the exclusive search for the new and the hot—so that an unproven artist such as Wade Guyton, now showing at the Whitney Museum in New York, can fetch more than a legend of pop art like Richard Artschwager, on view downstairs from Guyton’s work.

(Every gallerist I spoke to insisted that the market for their particular, singularly talented artists was bound to be stable, even if their colleagues were clearly at risk—precisely the kind of bulletproof thinking that’s typical of boom times.)

That Barclays survey showed that once millionaires own a precious object, they will only sell it at a vast profit. (Market psychologists call this the “endowment effect.”) Just because you think the value of your collection is falling, “you’re not going to take your paintings off the wall,” says Adam Lindemann, a financier, collector, and gallery owner in New York.

Of course, the fact that collectors choose not to sell now, or in 2013, or even in a decade doesn’t change the underlying drop in worth of any bad art they own. If a work doesn’t end up mattering in the culture at large, someone, someday, will be left holding the bag.